MCA: ACTIVE (Active Company Tagging Identities & Verification)

MCA has introduced new E-form INC-22A [Rule 25A of the Companies (Incorporation) Rules, 2014] for tagging and verification of registered offices of the companies.

Applicability: Every Company incorporated on or before 31st December 2017 is required to comply by the above form.

Due Date: On or before 25th April 2019 (One time).

Companies barred from filing Form INC-22A:

- Companies whose due Financial Statements or due Annual return or both has not been filed, will not be able to file ACTIVE form (except such company is under management dispute and the same has been recorded with the registrar).

- Accordingly, such above companies whose compliances are pending to be updated with MCA shall not be able to file the ACTIVE form.

Companies not required to file Form INC-22A:

Major Amendments in GST ACT(s) Applicable from 01.02.2019

After receiving the assent from The President of India on 22nd August 2018, the GST Council in its 31st meeting held on 22nd December 2018, announced following amendments in GST Act(s) 2017 which have now got effective from 01st of February 2019.

The government has made various important changes in CGST and IGST Act which were applicable from 1st February 2019. To understand the important amendments the comparison between provisions contained under old GST Act 2017 and GST Amendment Act 2018along with our team’s germane analysis is presented in a tabular fashion below:

| Section | Earlier Provision | Amended Provisions from 01.02.2019 | Analysis of changes |

| Section 7 – Definition of ‘Supply’ | 1) For the purposes of this Act, the expression “supply” includes– (a) all forms of supply of goods or services or both such as sale, transfer, barter, exchange, licence, rental, lease or disposal made or agreed to be made for a consideration by a person in the course or furtherance of business; (b) import of services for a consideration whether or not in the course or furtherance of business; (c) the activities specified in Schedule I, made or agreed to be made without a consideration; and (d) the activities to be treated as supply of goods or supply of services as referred to in Schedule II. (2) Notwithstanding anything contained in sub-section (1), –– (a) activities or transactions specified in Schedule III; or (b) such activities or transactions undertaken by the Central Government, a State Government or any local authority in which they are engaged as public authorities, as may be notified by the Government on the recommendations of the Council, shall be treated neither as a supply of goods nor a supply of services. (3) Subject to the provisions of sub-sections (1) and (2), the Government may, on the recommendations of the Council, specify, by notification, the transactions that are to be treated as— (a) a supply of goods and not as a supply of services; or (b) a supply of services and not as a supply of goods. | 1) For the purposes of this Act, the expression “supply” includes– (a) all forms of supply of goods or services or both such as sale, transfer, barter, exchange, licence, rental, lease or disposal made or agreed to be made for a consideration by a person in the course or furtherance of business; (b) import of services for a consideration whether or not in the course or furtherance of business; and (c) the activities specified in Schedule I made or agreed to be made without a consideration, | Amendments under this section were given retrospective effecti.e. such amendments shall become operational w.e.f. 01.07.2017. The amendment will help to ensure that the activities specified in schedule II will be taxed, only when the activity is constituted as supply in accordance of provisions of section 7 (1). Govt. has provided clarification to end any controversial interpretation, stating that merely mentioning of an activity in schedule II do not bring it under tax net of GST, unless it is ‘supply’perse. |

| Section 9(4) – Reverse charge on inward supply from unregistered persons | The central tax in respect of the supply of taxable goods or services or both by a supplier, who is not registered, to a registered person shall be paid by such person on reverse charge basis as the recipient and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both. | Completely changed Sub-section: The Government may, on the recommendations of the Council, by notification, specify a class of registered persons who shall, in respect of supply of specified categories of goods or services or both received from an unregistered supplier, pay the tax on reverse charge basis as the recipient of such supply of goods or services or both, and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to such supply of goods or services or both”. | Before such amendment, every registered person has to pay GST under reverse charge on procurement of inward supply from unregistered person, subject to monetary limit of INR 5,000 per day. W.e.f. 13.10.2017, govt. had suspended the applicability of this subsection till 30.09.2019. Now reverse charge on receipt of inward supplies from an unregistered supplier will be applicable only to 1. certain class of registered persons2. on purchase of certain goods or services, Such class of persons and category of goods & services is yet to be notified. Respective amendments hasalso been made in Section 5(4) of IGST Act. |

| Section 10 – Composition Levy | (1) Notwithstanding anything to the contrary contained in this Act but subject to the provisions of sub-sections (3) and (4) of section 9, a registered person, whose aggregate turnover in the preceding financial year did not exceed fifty lakh rupees, may opt to pay, in lieu of the tax payable by him, an amount calculated at such rate as may be prescribed, but not exceeding, –– (a) one per cent. of the turnover in State or turnover in Union territory in case of a manufacturer, (b) two and a half per cent. of the turnover in State or turnover in Union territory in case of persons engaged in making supplies referred to in clause (b) of paragraph 6 of Schedule II, and (c) half per cent. of the turnover in State or turnover in Union territory in case of other suppliers, subject to such conditions and restrictions as may be prescribed: Provided that the Government may, by notification, increase the said limit of fifty lakh rupees to such higher amount, not exceeding one crore rupees, as may be recommended by the Council. (2) The registered person shall be eligible to opt under sub-section (1), if: — (a) he is not engaged in the supply of services other than supplies referred to in clause(b) of paragraph 6 of Schedule II; (b) he is not engaged in making any supply of goods which are not leviable to tax under this Act; (c) he is not engaged in making any inter-State outward supplies of goods; (d) he is not engaged in making any supply of goods through an electronic commerce operator who is required to collect tax at source under section 52; and (e) he is not a manufacturer of such goods as may be notified by the Government on the recommendations of the Council: Provided that where more than one registered persons are having the same Permanent Account Number (issued under the Income-tax Act, 1961), the registered person shall not be eligible to opt for the scheme under sub-section (1) unless all such registered persons opt to pay tax under that sub-section. (3) The option availed of by a registered person under sub-section (1) shall lapse with effect from the day on which his aggregate turnover during a financial year exceeds the limit specified under sub-section (1). (4) A taxable person to whom the provisions of sub-section (1) apply shall not collect any tax from the recipient on supplies made by him nor shall he be entitled to any credit of input tax. (5) If the proper officer has reasons to believe that a taxable person has paid tax under sub-section (1) despite not being eligible, such person shall, in addition to any tax that may be payable by him under any other provisions of this Act, be liable to a penalty and the provisions of section 73 or section 74 shall, mutatis mutandis, apply for determination of tax and penalty. | (1) Notwithstanding anything to the contrary contained in this Act but subject to the provisions of sub-sections (3) and (4) of section 9, a registered person, whose aggregate turnover in the preceding financial year did not exceed fifty lakh rupees, may opt to pay, in lieu of the tax payable by him under sub-section (1) of section 9, an amount of tax calculated at such rate as may be prescribed, but not exceeding,–– (a) one per cent of the turnover in State or turnover in Union territory in case of a manufacturer, (b) two and a half per cent. of the turnover in State or turnover in Union territory in case of persons engaged in making supplies referred to in clause (b) of paragraph 6 of Schedule II, and (c) half per cent. of the turnover in State or turnover in Union territory in case of other suppliers, subject to such conditions and restrictions as may be prescribed: Provided that the Government may, by notification, increase the said limit of fifty lakh rupees to such higher amount, not exceeding one crore and fifty lakh rupees, as may be recommended by the Council. “Provided further that a person who opts to pay tax under clause (a) or clause (b) or clause (c) may supply services (other than those referred to in clause (b) of paragraph 6 of Schedule II), of value not exceeding ten per cent. of turnover in a State or Union territory in the preceding financial year or five lakh rupees, whichever is higher.”; (2) The registered person shall be eligible to opt under sub-section (1), if— (a) save as provided in sub-section (1), he is not engaged in the supply of services, | This amendment give effect to the recommendations of GST Council to increase the ceiling limit for opting composition scheme from 1crore to 1.50 crore. Further, the manufacturer and traders can opt for composition scheme even if they supply services, provided that the value of such service should not exceed 5 lakh or 10% of turnoverin the preceding FY, whichever is high. This amendment is directed to solve the problem of small businesses who were earlier unable to opt for composition in lieu of very small income of service nature (like commercial rent, commission etc) |

| Section 17(3) – Apportionment of credit | (3) The value of exempt supply under sub-section (2) shall be such as may be prescribed and shall include supplies on which the recipient is liable to pay tax on reverse charge basis, transactions in securities, sale of land and, subject to clause (b) of paragraph 5 of Schedule II, sale of building. | (3) The value of exempt supply under sub-section (2) shall be such as may be prescribed and shall include supplies on which the recipient is liable to pay tax on reverse charge basis, transactions in securities, sale of land and, subject to clause (b) of paragraph 5 of Schedule II, sale of building. ‘Explanation.—For the purposes of this sub-section, the expression ‘‘value of exempt supply’’ shall not include the value of activities or transactions specified in Schedule III, except those specified in paragraph 5 of the said Schedule. | By adding an explanation to section 17(3), it is clarified that no reversal of ITC shall be required in case of supply of transactions specified in Schedule III (other than sale of land as mentioned in point 5(b) of schedule II) |

| Section 17(5)(a) – Blocked credit | (5) Notwithstanding anything contained in sub-section (1) of section 16 and subsection (1) of section 18, input tax credit shall not be available in respect of the following, namely: — (a) motor vehicles and other conveyances except when they are used–– (i) for making the following taxable supplies, namely: — (A) further supply of such vehicles or conveyances; or (B) transportation of passengers; or (C) imparting training on driving, flying, navigating such vehicles or conveyances; (ii) for transportation of goods; | (5) Notwithstanding anything contained in sub-section (1) of section 16 and sub-section (1) of section 18, input tax credit shall not be available in respect of the following, namely: — (a) motor vehicles | Following are the take-aways from this amendment: 1. ITC can only be availed on motor vehicles having approved seating capacity of more than 13 persons. 2. The confusion regarding availment of ITC in relation to work-trucks, fork lifts, cranes, etc. has been clarified. The word ‘other conveyance’ has been removed to clarify the intention in this regard. 3. This amendment disallows ITC of services w.r.t.general insurance,repair & maintenance of such motor vehicles, vessel and/or aircraft of which ITC perseis not allowed. 4. The ever-asking question of availability of ITC w.r.t. motor-vehicles and/or its repair & maintenance including insurance, is answered finally that no credit of such expenditure shall be allowed. |

| Section 17(5)(b) – Blocked credit | (b) the following supply of goods or services or both— (i) food and beverages, outdoor catering, beauty treatment, health services, cosmetic and plastic surgery except where an inward supply of goods or services or both of a particular category is used by a registered person for making an outward taxable supply of the same category of goods or services or both or as an element of a taxable composite or mixed supply; (ii) membership of a club, health and fitness centre; (iii) rent-a-cab, life insurance and health insurance except where–– (A) the Government notifies the services which are obligatory for an employer to provide to its employees under any law for the time being in force; or (B) such inward supply of goods or services or both of a particular category is used by a registered person for making an outward taxable supply of the same category of goods or services or both or as part of a taxable composite or mixed supply; and (iv) travel benefits extended to employees on vacation such as leave or home travel Concession; | (b) the following supply of goods or services or both— (i) food and beverages, outdoor catering, beauty treatment, health services, cosmetic and plastic surgery, leasing, renting or hiring of motor vehicles, vessels or aircraft referred to in clause (a) or clause (aa) except when used for the purposes specified therein, life insurance and health insurance: Provided that the input tax credit in respect of such goods or services or both shall be available where an inward supply of such goods or services or both is used by a registered person for making an outward taxable supply of the same category of goods or services or both or as an element of a taxable composite or mixed supply; (ii) membership of a club, health and fitness centre; and | ITC on leasing and hiring of motor vehicles, vessel & aircrafts is restricted to only such cases when they are used for the specific purpose as mentioned in clause (a) or (aa). Earlier the Govt. was to notify such services which were obligatory for an employer to provide to its employees and ITC of such services shall be allowed, however via this amendment Govt. has notified such services in the section itself wherein ITC can be availed on food beverages, outdoor catering, health insurance, rent-a-cab etc. (services of personal nature) if the same is obligatory for an employer to provide to its employees under any law for the time being in force. |

| Section 22(1) – Persons liable for registration | 22 (1) Every supplier shall be liable to be registered under this Act in the State or Union territory, other than special category States, from where he makes a taxable supply of goods or services or both, if his aggregate turnover in a financial year exceeds twenty lakh rupees: Provided that where such person makes taxable supplies of goods or services or both from any of the special category States, he shall be liable to be registered if his aggregate turnover in a financial year exceeds ten lakh rupees. | 22 (1) Every supplier shall be liable to be registered under this Act in the State or Union territory, other than special category States, from where he makes a taxable supply of goods or services or both, if his aggregate turnover in a financial year exceeds twenty lakh rupees: Provided that where such person makes taxable supplies of goods or services or both from any of the special category States, he shall be liable to be registered if his aggregate turnover in a financial year exceeds ten lakh rupees. Provided further that the Government may, at the request of a special category State and on the recommendations of the Council, enhance the aggregate turnover referred to in the first proviso from ten lakh rupees to such amount, not exceeding twenty lakh rupees and subject to such conditions and limitations, as may be so notified. | By inserting a proviso, Govt. has enableditself, if required upon request received from any special category state, to increase threshold limitfor obtaining GST registration in such,from 10 lakh to 20 lakhs. |

| Section 22 (Explanation) –Person liable to registration | Explanation (iii) to section 22 the expression “special category States” shall mean the States as specified in sub-clause (g) of clause (4) of article 279A of the Constitution except the State of Jammu and Kashmir. | Explanation (iii) to section 22 the expression “special category States” shall mean the States as specified in sub-clause (g) of clause (4) of article 279A of the Constitution except the State of Jammu and Kashmir and States of Arunachal Pradesh, Assam, Himachal Pradesh, Meghalaya, Sikkim and Uttarakhand. | The amended in explanation has led to an increase in threshold limit for obtaining GST registration in the state of Arunachal Pradesh, Assam, Himachal Pradesh, Meghalaya, Sikkim and Uttarakhand from earlier 10 lakhs to now 20 lakhs. |

| Section 24 –Compulsory Registration | (x) every electronic commerce operator. | (x) every electronic commerce operator who is required to collect tax at source under section 52. | This amendment enables the small e-commerce operators to avail the benefit of threshold limit for obtaining GST registration. |

| Section 25 –Procedure for Registration | 25 (1) Every person who is liable to be registered under section 22 or section 24 shall apply for registration in every such State or Union territory in which he is so liable within thirty days from the date on which he becomes liable to registration, in such manner and subject to such conditions as may be prescribed: Provided that a casual taxable person or a non-resident taxable person shall apply for registration at least five days prior to the commencement of business. Explanation. — Every person who makes a supply from the territorial waters of India shall obtain registration in the coastal State or Union territory where the nearest point of the appropriate baseline is located. (2) A person seeking registration under this Act shall be granted a single registration in a State or Union territory: Provided that a person having multiple business verticals in a State or Union territory may be granted a separate registration for each business vertical, subject to such conditions as may be prescribed. | 25 (1) Every person who is liable to be registered under section 22 or section 24 shall apply for registration in every such State or Union territory in which he is so liable within thirty days from the date on which he becomes liable to registration, in such manner and subject to such conditions as may be prescribed: Provided that a casual taxable person or a non-resident taxable person shall apply for registration at least five days prior to the commencement of business. Provided further that a person having a unit, as defined in the Special Economic Zones Act, 2005, in a Special Economic Zone or being a Special Economic Zone developer shall have to apply for a separate registration, as distinct from his place of business located outside the Special Economic Zone in the same State or Union territory. Explanation. — Every person who makes a supply from the territorial waters of India shall obtain registration in the coastal State or Union territory where the nearest point of the appropriate baseline is located. (2) A person seeking registration under this Act shall be granted a single registration in a State or Union territory: Provided that a person having multiple | By inserting proviso in sub-section(1),it is now made mandatory for a SEZ unit or developer to obtain separate GST registrations for unit in SEZ area and unit located outside SEZ area even when both such units are within a same state. Amendment in second proviso to sub-section (2), allows the users to take separate registrations for each place of business within same state. The earlier requirement of having separate business vertical to obtain separate registration has been done away with. |

| Section 29 –Cancellation or Suspension of Registration | 29(1)…..(a)….(b)…. (c) the taxable person, other than the person registered under sub-section (3) of section 25, is no longer liable to be registered under section 22 or section 24. | 29(1)…..(a)….(b)…. (c) the taxable person, other than the person registered under subsection (3) of section 25, is no longer liable to be registered under section 22 or section 24. Provided that during pendency of the proceedings relating to cancellation of registration filed by the registered person, the registration may be suspended for such period and in such manner as may be prescribed. | By inserting this proviso, govt. has extended relief to a taxpayers applying for surrender of GST registration from regular compliance during the period from such application till order of surrender. |

| Section 34 – Debit and Credit Notes | 34 (1) Where a tax invoice has been issued for supply of any goods or services or both and the taxable value or tax charged in that tax invoice is found to exceed the taxable value or tax payable in respect of such supply, or where the goods supplied are returned by the recipient, or where goods or services or both supplied are found to be deficient, the registered person, who has supplied such goods or services or both, may issue to the recipient a credit note containing such particulars as may be prescribed. (2) Any registered person who issues a credit note in relation to a supply of goods or services or both shall declare the details of such credit note in the return for the month during which such credit note has been issued but not later than September following the end of the financial year in which such supply was made, or the date of furnishing of the relevant annual return, whichever is earlier, and the tax liability shall be adjusted in such manner as may be prescribed: Provided that no reduction in output tax liability of the supplier shall be permitted, if the incidence of tax and interest on such supply has been passed on to any other person. (3) Where a tax invoice has been issued for supply of any goods or services or both and the taxable value or tax charged in that tax invoice is found to be less than the taxable value or tax payable in respect of such supply, the registered person, who has supplied such goods or services or both, shall issue to the recipient a debit note containing such particulars as may be prescribed. | 34(1) Where | The amendment is to provide a big relief to taxpayers enabling them to issue single debit/credit note against multiple invoices issued in a Financial Year.Practical problem of linking each debit/note to particular invoice has been resolved. |

| Section 35(5) – Accounts and other records | 35 (5) Every registered person whose turnover during a financial year exceeds the prescribed limit shall get his accounts audited by a chartered accountant or a cost accountant and shall submit a copy of the audited annual accounts, the reconciliation statement under sub-section (2) of section 44 and such other documents in such form and manner as may be prescribed. | 35 (5) Every registered person whose turnover during a financial year exceeds the prescribed limit shall get his accounts audited by a chartered accountant or a cost accountant and shall submit a copy of the audited annual accounts, the reconciliation statement under sub-section (2) of section 44 and such other documents in such form and manner as may be prescribed: Provided that nothing contained in this sub-section shall apply to any department of the Central Government or a State Government or a local authority, whose books of account are subject to audit by the Comptroller and Auditor-General of India or an auditor appointed for auditing the accounts of local authorities under any law for the time being in force. | As per this amendment, those government departments whose accounts are required to be audited by CAG need not to get their accounts audited by a Chartered Accountant or Cost Accountant under GST. |

| Section 39 – Furnishing of returns | 39 (1) Every registered person, other than an Input Service Distributor or a non-resident taxable person or a person paying tax under the provisions of section 10 or section 51 or section 52 shall, for every calendar month or part thereof, furnish, in such form and manner as may be prescribed, a return, electronically, of inward and outward supplies of goods or services or both, input tax credit availed, tax payable, tax paid and such other particulars as may be prescribed, on or before the twentieth day of the month succeeding such calendar month or part thereof. (2) ……(3) ……(4) ……(5) ……(6) …… (7) Every registered person, who is required to furnish a return under sub-section (1) or sub-section (2) or sub-section (3) or sub-section (5), shall pay to the Government the tax due as per such return not later than the last date on which he is required to furnish such return. (8) …… (9) Subject to the provisions of sections 37 and 38, if any registered person after furnishing a return under sub-section (1) or sub-section (2) or sub-section (3) or sub-section (4) or sub-section (5) discovers any omission or incorrect particulars therein, other than as a result of scrutiny, audit, inspection or enforcement activity by the tax authorities, he shall rectify such omission or incorrect particulars in the return to be furnished for the month or quarter during which such omission or incorrect particulars are noticed, subject to payment of interest under this Act: Provided that no such rectification of any omission or incorrect particulars shall be allowed after the due date for furnishing of return for the month of September or second quarter following the end of the financial year, or the actual date of furnishing of relevant annual return, whichever is earlier. | 39 (1) Every registered person, other than an Input Service Distributor or a non-resident taxable person or a person paying tax under the provisions of section 10 or section 51 or section 52 shall, for every calendar month or part thereof, furnish, | This amendment empowers the government to notify class of such persons who shall be to file their returns quarterly. The amendment is to give effect to rollout the new return formats from June 2019. For the much awaited and discussed issue w.r.t. provisions for rectification of errors or omission of any data already filed through returns, this amendment enables govt. to introduce separate new form for amendment in returns. |

| Section 43A – Procedure for furnishing return and availing input tax credit | New Section | (1) Notwithstanding anything contained in sub-section (2) of section 16, section 37 or section 38, every registered person shall in the returns furnished under sub-section (1) of section 39 verify, validate, modify or delete the details of supplies furnished by the suppliers.(2) Notwithstanding anything contained in section 41, section 42 or section 43, the procedure for availing of input tax credit by the recipient and verification thereof shall be such as may be prescribed.(3) The procedure for furnishing the details of outward supplies by the supplier on the common portal, for the purposes of availing input tax credit by the recipient shall be such as may be prescribed.(4) The procedure for availing input tax credit in respect of outward supplies not furnished under sub-section (3) shall be such as may be prescribed, and such procedure may include the maximum amount of the input tax credit which can be so availed, not exceeding twenty per cent. of the input tax credit available, on the basis of details furnished by the suppliers under the said sub-section.(5) The amount of tax specified in the outward supplies for which the details have been furnished by the supplier under sub-section (3) shall be deemed to be the tax payable by him under the provisions of the Act.(6) The supplier and the recipient of a supply shall be jointly and severally liable to pay tax or to pay the input tax credit availed, as the case may be, in relation to outward supplies for which the details have been furnished under sub-section (3) or sub-section (4) but return thereof has not been furnished.(7) For the purposes of sub-section (6), the recovery shall be made in such manner as may be prescribed and such procedure may provide for non-recovery of an amount of tax or input tax credit wrongly availed not exceeding one thousand rupees.(8) The procedure, safeguards and threshold of the tax amount in relation to outward supplies, the details of which can be furnished under sub-section (3) by a registered person, —(i) within six months of taking registration;(ii) who has defaulted in payment of tax and where such default has continued for more than two months from the due date of payment of such defaulted amount shall be such as may be prescribed.”. | New Section provides for the procedure for availing ITC in parity with the new return procedures (to be announced) from June 2019. The supplier and the recipient are jointly and severally made liable to pay tax for details furnished/ not furnished by the supplier in his respective GSTR-1 butthe return (GSTR 3B) has not been furnished. |

| Sec 49 (5)(c) & (d) –Payment of Tax | 49 (5) The amount of input tax credit available in the electronic credit ledger of the registered person on account of–– (a)….(b)…. (c) the State tax shall first be utilised towards payment of State tax and the amount remaining, if any, may be utilised towards payment of integrated tax; (d) the Union territory tax shall first be utilised towards payment of Union territory tax and the amount remaining, if any, may be utilised towards payment of integrated tax. | 49 (5) The amount of input tax credit available in the electronic credit ledger of the registered person on account of –– (a)….(b)…. (c) the State tax shall first be utilized towards payment of State tax and the amount remaining, if any, may be utilized towards payment of integrated tax; Provided that the input tax credit on account of State tax shall be utilised towards payment of integrated tax only where the balance of the input tax credit on account of central tax is not available for payment of integrated tax;”; (d) the Union territory tax shall first be utilized towards payment of Union territory tax and the amount remaining, if any, may be utilized towards payment of integrated tax; Provided that the input tax credit on account of Union territory tax shall be utilised towards payment of integrated tax only where the balance of the input tax credit on account of central tax is not available for payment of integrated tax. | This amendment has provided new procedure of settlement of IGST/CGST/SGST tax amount. Credit of SGST/ UTGST can be utilized for payment of IGST only when the balance of the input tax credit on account of CGST is not available for payment of IGST. |

| Section 49A – Utilisation of input tax credit subject to certain conditions | New Section | Notwithstanding anything contained in section 49, the input tax credit on account of central tax, State tax or Union territory tax shall be utilised towards payment of integrated tax, central tax, State tax or Union territory tax, as the case may be, only after the input tax credit available on account of integrated tax has first been utilised fully towards such payment. | The taxpayer can utilize credit of CGST/UGST only after utilizing all credit of IGST available. Earlier CGST/SGST ITC was used to set-off CGST /SGST liability, as the case may be, but now IGST Credit has to be 1st utilised fully for payment of IGST then for CGST and then for SGST liability as the case may be, even before utilisation of ITC of CGST or SGST. |

| Section 49B – Order of utilisation of input tax credit | New Section | 49B. Notwithstanding anything contained in this Chapter and subject to the provisions of clause (e) and clause (f) of sub-section (5) of section 49, the Government may, on the recommendations of the Council, prescribe the order and manner of utilisation of the input tax credit on account of integrated tax, central tax, State tax or Union territory tax, as the case may be, towards payment of any such tax. | This section is to give power to government to specify any order for utilization of ITC, on recommendation of GST Council. |

| Section 54(8)(a) – Refunds | (a) refund of tax paid on zero-rated supplies of goods or services or both or on inputs or input services used in making such zero-rated supplies; | (a) refund of tax paid on | This amendment is in consonance of the concept of unjust enrichment. Thereby, taxpayer is not eligible to claim refund of tax paid on supplies made to SEZ unit or SEZ developer. |

| Section 54 Explanation (2)(e) – Relevant date for filing refunds in case of inverted duty structure | (e) in the case of refund of unutilised input tax credit under sub-section (3), the end of the financial year in which such claim for refund arises. | (e) in the case of refund of unutilised input tax credit under clause (ii) of first proviso to sub-section (3), the | Maximum period of 2 years for claiming refund shall be counted the date of furnishing return under section 39 in the case of refund on account of inverted duty structure.Earlier such relevant date was from end of FY to which such refund relates. |

| Section 79(4) – Recovery of tax | 79 (4) Where the amount recovered under sub-section (3) is less than the amount due to the Central Government and State Government, the amount to be credited to the account of the respective Governments shall be in proportion to the amount due to each such Government. | 79 (4) Where the amount recovered under sub-section (3) is less than the amount due to the Central Government and State Government, the amount to be credited to the account of the respective Governments shall be in proportion to the amount due to each such Government. Explanation. –– For the purposes of this section, the word person shall include “distinct persons” as referred to in sub-section (4) or, as the case may be, sub-section (5) of section 25. | With a major consequence involved,in case of any recovery is due from one unit in a particular statethis amendment empowers authority to recover such due amount from another unit of same person located in different state also. |

| Section 107(6)(b) – Appeal to Appellate Authority | (b) a sum equal to ten per cent. of the remaining amount of tax in dispute arising from the said order, in relation to which the appeal has been filed. | (b) a sum equal to ten per cent. of the remaining amount of tax in dispute arising from the said order subject to a maximum of twenty-five crore rupees, in relation to which the appeal has been filed. | Law has restricted the maximum ceiling of pre-deposit in case of appeals to Appellate Authority to 25 crores.Earlier there was no ceiling limit. |

| Section 112(8)(b) – Appeal to Appellate Tribunal | b) a sum equal to twenty per cent. of the remaining amount of tax in dispute, in addition to the amount paid under sub-section (6) of section 107, arising from the said order, in relation to which the appeal has been filed. | (b) a sum equal to twenty per cent. of the remaining amount of tax in dispute, in addition to the amount paid under sub-section (6) of section 107, arising from the said order subject to a maximum of fifty crore rupees, in relation to which the appeal has been filed. | Law has restricted the maximum ceiling of pre-deposit in case of appeals to Appellate Tribunal to 50 crores. Earlier there was no ceiling limit. |

| Section 129(6) – Detention, seizure and release of goods and conveyances in transit | 129 (6) Where the person transporting any goods, or the owner of the goods fails to pay the amount of tax and penalty as provided in sub-section (1) within seven days of such detention or seizure, further proceedings shall be initiated in accordance with the provisions of section 130: Provided that where the detained or seized goods are perishable or hazardous in nature or are likely to depreciate in value with passage of time, the said period of seven days may be reduced by the proper officer. | 129 (6) Where the person transporting any goods, or the owner of the goods fails to pay the amount of tax and penalty as provided in sub-section (1) within | In case of seizure of goods, time limit for initiating proceedings under section 130has been increased from seven days to fourteen days. |

| Schedule I | Paragraph 4. Import of services by a taxable person from a related person or from any of his other establishments outside India, in the course or furtherance of business. | Paragraph 4. Import of services by a | An entity,even though not registered under GST,if receives services from their related parties located outside India, in course or furtherance of business, falls under an ambit of GST. |

| Schedule III | New paragraphs inserted | 7. Supply of goods from a place in the non-taxable territory to another place in the non-taxable territory without such goods entering into India.8. (a) Supply of warehoused goods to any person before clearance for home consumption; (b) Supply of goods by the consignee to any other person, by endorsement of documents of title to the goods, after the goods have been dispatched from the port of origin located outside India but before clearance for home Consumption.Explanation. 1 — For the purposes of paragraph 2, the term “court” includes District Court, High Court and Supreme Court. Explanation 2. ––For the purposes of paragraph 8, the expression “warehoused goods” shall have the same meaning as assigned to it in the Customs Act, 1962. | Reversal of common ITC under Rue 42/43 is not required in the case of High Seas Sale. Another disputed issue has been resolved with this amendment. |

Major Amendments under IGST Act:

| Section | Earlier Provision | Amended Provisions from 01.02.2019 | Analysis of changes |

| Section 2(6) – Definition of ‘Export of services’ | 2 (6) “export of services” means the supply of any service when, –– (i) the supplier of service is located in India; (ii) the recipient of service is located outside India; (iii) the place of supply of service is outside India; (iv) the payment for such service has been received by the supplier of service in convertible foreign exchange; and (v) the supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 in section 8. | 6) “export of services” means the supply of any service when, –– (i) the supplier of service is located in India; (ii) the recipient of service is located outside India; (iii) the place of supply of service is outside India; (iv) the payment for such service has been received by the supplier of service in convertible foreign exchange or in Indian Rupees wherever permitted by the Reserve Bank of India; and (v) the supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 in section 8. | The amendment allows to avail export benefits to such service providers who export services to person located in Nepal, Bhutan and consideration is received in INR. |

| Section 12(8) – Place of supply of domestic services of transportation of goods | 2 (8) The place of supply of services by way of transportation of goods, including by mail or courier to, –– (a) a registered person shall be the location of such person; (b) a person other than a registered person, shall be the location at which such goods are handed over for their transportation. | 12 (8) The place of supply of services by way of transportation of goods, including by mail or courier to, – (a) a registered person shall be the location of such person; (b) a person other than a registered person, shall be the location at which such goods are handed over for their transportation: Provided that where the transportation of goods is to a place outside India, the place of supply shall be the place of destination of such goods. | In order to reduce export cost in case of goods, the proviso provides that no GST shall be chargeable on transportation of goods from a place in India to a place outside India. |

| Section 13(3) – Place of supply of performance-based services | 13 (3) The place of supply of the following services shall be the location where the services are actually performed, namely: — (a) services supplied in respect of goods which are required to be made physically available by the recipient of services to the supplier of services, or to a person acting on behalf of the supplier of services in order to provide the services: Provided that when such services are provided from a remote location by way of electronic means, the place of supply shall be the location where goods are situated at the time of supply of services: Provided further that nothing contained in this clause shall apply in the case of services supplied in respect of goods which are temporarily imported into India for repairs and are exported after repairs without being put to any other use in India, than that which is required for such repairs; | 13 (3) The place of supply of the following services shall be the location where the services are actually performed, namely: — (a) services supplied in respect of goods which are required to be made physically available by the recipient of services to the supplier of services, or to a person acting on behalf of the supplier of services in order to provide the services: Provided that when such services are provided from a remote location by way of electronic means, the place of supply shall be the location where goods are situated at the time of supply of services: Provided further that nothing contained in this clause shall apply in the case of services supplied in respect of goods which are temporarily imported into India for repairs or for any other treatment or process and are exported after such repairs or treatment or process without being put to any | No GST shall be chargeable in case, goods are imported in India for treatment or any process and then exported back out of India. |

DISCLAIMER: The analysis given is strictly the view of author. The contents of this article are solely for informational purpose. It does not constitute professional advice or recommendation of author. The author is not responsible for any loss or damage of any kind arising out of any information in this article.

(The author can be reached at parveen@bgmg.co.in)

Prohibition on Unregulated Deposit Schemes w.e.f February 21,2019

In order to put a check on illicit deposit taking activities like Saradha scam and Rose Valley chit fund scam in the country that dupe poor and the financially illiterate of their hard-earned savings. The President of India promulgated the Banning of Unregulated Deposit Scheme Ordinance w.e.f. February 21, 2019 (hereinafter referred to as ‘BUDS’) which seek to curb the menace of Ponzi schemes and make such unregulated deposit scheme punishable.

What the ordinances is all about?

The legislation contains a substantive banning clause which bans deposit takers from promoting, operating, issuing advertisements or accepting deposits in any Unregulated Deposit Scheme.

Questions pinching the Industry as a whole

Q1. Whether the ordinance intends to ban all deposits as defined therein?

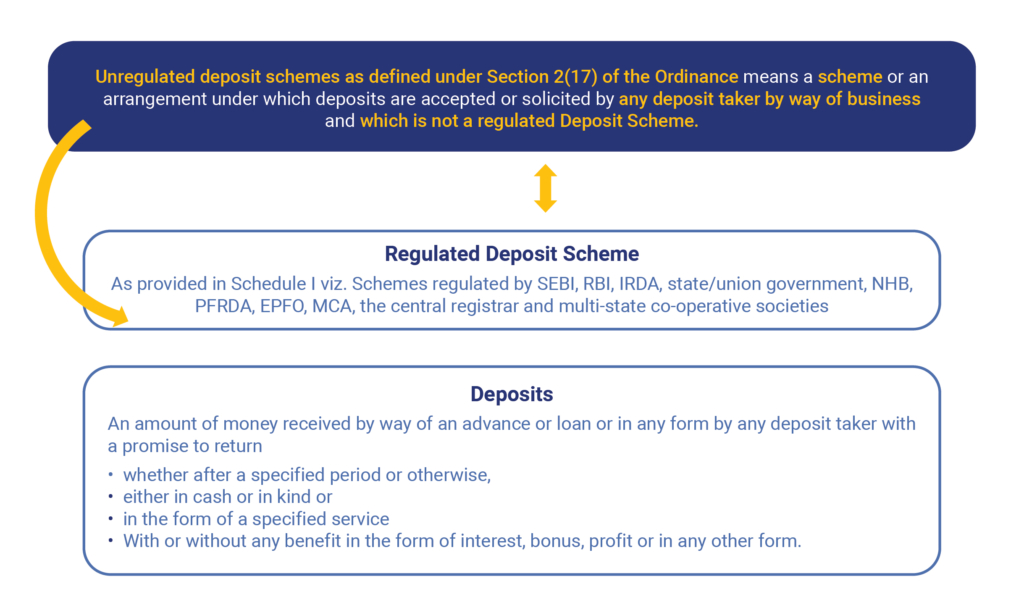

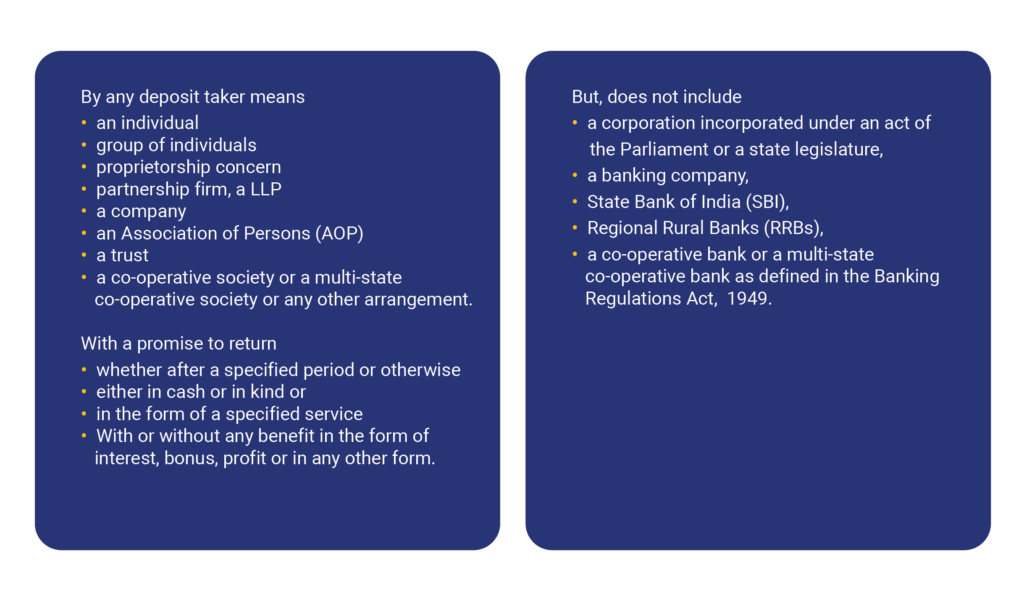

The term Deposits has been defined under Section 2(14) of the Ordinance as:An amount of money received by way of an advance or loan or in any other form, by any deposit taker:

List of activities excluded from the definition of deposits, i.e. kept out of the ambit of Deposits per se:

| S. No. | Activities |

| 1. | Loans received from banks; |

| 2. | Loans/ financial assistance from private finance institutions (PFIs) or any registered non-banking financial companies (NBFCs), regional financial institutions and insurance companies; |

| 3. | Amount received from or guaranteed by appropriate government; |

| 4. | Amount received from a statutory authority; |

| 5. | Amounts received from foreign government, foreign banks, and foreign authorities or person resident outside India as per the provisions of the Foreign Exchange Management Act (FEMA) 1999; |

| 6. | Capital contributions by partners of a partnership firm or LLP; |

| 7. | Loans received by an individual from his relatives; |

| 8. | Loans received by a firm from relatives of partners; |

| 9. | Any credit given by a seller to a buyer on the sale of any property (whether movable or immovable); |

| 10. | Amounts received by a registered Asset Reconstruction Company (ARC); |

| 11. | Amounts received under Section 34 or Section 29B of the Representation of the People Act, 1951; |

| 12. | Any periodic payment made by the members of self-help groups as per the ceiling prescribed by state/ Union territory government; |

| 13. | Amount received in the course of, or for the purpose of, business and bearing a genuine connection to such business for following and which has not become refundable (including for reasons where deposit taker did not obtain the necessary permission or approval under the law for the time being in force, wherever required, to deal in the goods or properties or services for which money is taken):a) Payment, advance or part payment for supply/ hire of goods / services;b) Advance received in connection with and adjusted towards consideration of an immoveable property under an agreement or arrangement;c) Security deposit;d) Advance under long-term projects for supply of capital goods; |

The definition of Deposits has been kept wide under the Ordinance, creating a lot of interest and confusion in the business circles about this law.

However, it should be noted that as per relevant Section 3 read with Section 2(17) of the Ordinance, the government has promulgated to ban any unregulated deposit scheme thereby restricting any deposit taker to promote, operate or do any such related activity including accepting of deposits in pursuance of any Unregulated Deposit Schemes. Nonetheless, it is nowhere intended to ban the “deposit” per se.

Q2. What shall be the impact of this ordinance on deposits from a third persons for genuine business for instance personal/business loans undertaken by any trading/manufacturing/service concern organised as proprietorship/partnership/individuals/Co. etc.?

The ordinance under Chapter II mandates banning of unregulated deposit schemes and deposit schemes here refers to acceptance/ solicitation of deposits by deposit takers by way of any business.

It is mentionable here that What should be understood “by way of any business” is of utmost importance. The term has nowhere been defined in the Ordinance itself or otherwise. However, based upon logical reasoning the author is of the view it refers to such businesses which are primarily involved in taking deposits i.e., where collecting deposit is the prime / substantial activity of the business. In case of normal business-liketrading, manufacturing or service providers etc., whether constituted as proprietorship/partnership or otherwise acceptance of deposits is not the primary activity hence they could not be termed as deposit takers by way of business.

Here, the intention of the lawmakers is to protect the depositors from being defrauded by illicit deposit / ponzi schemes like chit fund schemes, private committees etc. The normal business deposits/loansare not intended to be banned by such ordinance.

The above fact gets strengthened from the relevant Press Release Dated 20th February, 2018 By Finance Ministry appositely stating that “Deposit” is defined in such a manner that deposit takers are restricted from camouflaging public deposits as receipts, and at the same time not to curb or hinder acceptance of money by an establishment in the ordinary course of its business.

The suprafact further get reinforced via The Statement of Objects and Reasons to the Banning of Unregulated Deposits Schemes Bill 2018, the relevant extract is produced below

“Despite such diverse regulatory framework, schemes and arrangements leading to unauthorised collection of money and deposits fraudulently, by inducing public to invest in uncertain schemes promising high returns or other benefits, are still operating in the society.”

“The said Committee in its Report has recommended the requirement of “appropriate legislative provisions, coupled with effective administrative and enforcement measures in order to protect the hard-earned savings and investments made by millions of people”. Presently, there are considerable differences among State laws in protecting the interests of depositors, and many unregulated deposit taking schemes operate across State boundaries.”

Furthermore, the intention of banning only the unregulated deposit scheme could be understood from the Press Release Dated 03 August, 2018 By Finance Ministry (Status Report in Chit Fund Scam), relevant extract of such press release is briefed below as

“As of February, 2018, the Enforcement Directorate (ED) has taken up investigations in 52 cases against Ponzi schemes floated by firms/ companies under the provisions of the PML Act, 2002, where small investors have been cheated.”

“As of February, 2018, the Central Bureau of Investigation (CBI) has registered and investigated 133 cases in the last 3 years (11 in 2015, 12 in 2016 and 110 in 2017) against various Ponzi companies for fraud and scams on the basis of complaints and also on the basis of directions of the Courts.”

“The Banning of Unregulated Deposit Schemes Bill, 2018 has been introduced in the Lok Sabha on 18.07.2018. The proposed Bill will ban all such deposit schemes which are unregulated.”

Hence, the deposits/ loan from a third person for genuine business running shall not be regarded as aunregulated scheme for raising deposits and shall have no impact on account of such ordinance.

Q3. What shall be the ultimate Impact of the Ordinance?

Every Ponzi scheme results in creation of new laws and such reactive law-making adds to the business hardships of genuine entrepreneurs. Moreover, the penal provisions under such specially crafted laws are also equally scary.The intention of this ordinance is to prohibit unregulated depositschemes from defrauding investors considering the recent chit fund scams and ponzi schemes and not to pose any hardship to any genuine business preposition.

Revised List of Blocked Credit Under GST from 01.02.2019

Every registered person under GST can claim ITC of goods and services or both received in course or furtherance of business subject to certain stipulations as laid down primarily under Section 16, 17, and 18. Sub-section (5) of section 17(5) of Central Goods & Services Tax Act, 2017, gives comprehensive list of supplies on which Input tax credit is blocked, commonly known as “Blocked-Credit”. This list of blocked credit has been updated by amendment in GST Act which shall come into force from 1st February 2019 and the same is presented below in a tabular form for understanding purpose.

| Nature of Goods or Service or both | Exception (Who can claim ITC even when it is Blocked for others) | Examples |

| Motor Vehicle for transportation of persons with seating capacity not more than 13 persons (including driver), except when the supply used for:- a) Further supply of such motor vehicles b) Further engaged in business of Transportation of Passengers c) Training on driving of such motor vehicles | Credit shall be allowed only to such persons who are engaged in the supply of activities as mentioned in point no. a), b), & c) | Company purchase car for director use or employee’s transportation, the ITC on such motor vehicle is not allowed. But if such company purchase bus with seating capacity more than 13 persons for transportation of their employees, it can can claim ITC. |

| Purchase of Vessels and Aircraft except when they are used for:- a) Further supply of such vessel and aircraft b) Further engaged in business of Transportation of Passengers or Goods c) Training on navigation of such vessel or flying such aircraft | Credit shall be allowed only to such persons who are engaged in the supply of activities as mentioned in point no. a), b), & c). [Subject to availing the benefit of entry no. 9(ii) of notification no. 11/2017-CT (R).] | For example, ITC on purchase of aircraft for travel of Board of Directors of company cannot be availed. |

| Credit of following services not allowed w.r.t. motor vehicles, vessel and aircrafts as mentioned above a) Service of General insurance b) Servicing, repair and maintenance | Credit of such services will be allowed only to those who are eligible to avail ITC on purchase of such motor vehicles, vessels and aircrafts. The manufacturer of such motor vehicles, vessels and aircrafts can claim ITC on such services. The person engaged in the business of general insurance of such motor vehicles, vessels or aircraft insured by him. | A transport company purchase truck for transportation of goods can claim ITC of such services, but a company bought car for director in the name of company cannot avail ITC on such services. The vehicle manufacturers can claim ITC of such services like, TATA, Maruti, Honda etc. General insurance companies can avail the ITC of such services only in case where insurance is done w.r.t. motor vehicles, vessels and aircrafts by company and claimed by customer |

| Food & Beverages Outdoor Catering Beauty Treatment Health Services Cosmetic & Plastic Surgery Leasing Renting & Hiring of Motor Vehicles, Vessels and Aircrafts Life Insurance Health Insurance | Credit of ITC is allowed only to such persons who further use these supplies to provide same category of supply or as an element of a taxable composite or mixed supply. If any of these services are obligatory in nature under any law, then such registered person can claim ITC of such services. | Outdoor catering service availed by company for employees or any other person, the ITC on such service is not allowed. However, ITC of same is allowed if an outdoor caterer avail services of another caterer. Hiring of Bus for transportation of employees, or cab facility, the ITC is not allowed. Health insurance or Canteen in factory compulsory under Factory’s Act, then ITC can be claimed. |

| Membership of Club, health & Fitness Centre | If any of these services are obligatory in nature under any law, then such registered person can claim ITC of such services. | For example, Golf club membership paid by company, then ITC is not allowed. |

| Travel Benefit Extended to Employees on Vacation such as leave or home travel concession | If any of these services are obligatory in nature under any law, then such registered person can claim ITC of such services. | For example, air ticket sponsored by company for holiday of employee, then ITC is not allowed. |

| Works Contract Service used for immovable property other than plant & machinery but including repair maintenance and renovation to the extent of capitalization | Credit of ITC shall be allowed only to such persons who further use these supplies to provide same category of supply like construction of building etc. | ITC on construction of office and factory is not allowed. However, if repair & maintenance is done and the same is not capitalized in books then ITC is allowed. |

| Goods and services received for Construction of Immovable Property on his own account | Credit of ITC shall be allowed only to such persons who further use these supplies to provide same category of supply | ITC of goods and services not allowed for Construction of new office/factory, whether goods are purchase by company itself. |

| Composition Dealer | – | Goods and services on which tax is paid under composition scheme by the dealer, ITC shall not be allowed of such supply. |

| Goods and services received by Non-Resident Taxable Person | Non-resident person supply goods and services in India except in case where goods imported by him | This clause is applicable on non-resident persons only |

| Supply used for Personal Consumption | – | For example, fees of director personal income tax return paid by company, then ITC on such inward supply is not allowed |

| Goods Lost, Stolen, Destroyed, Written off, free samples | – | Goods stolen during transportation, then ITC is not allowed. |

| Tax Paid Under Section 74, 129 & 130 | – | ITC is not allowed where tax has been paid by any person due to fraud, wilful-misstatement |