In order to put a check on illicit deposit taking activities like Saradha scam and Rose Valley chit fund scam in the country that dupe poor and the financially illiterate of their hard-earned savings. The President of India promulgated the Banning of Unregulated Deposit Scheme Ordinance w.e.f. February 21, 2019 (hereinafter referred to as ‘BUDS’) which seek to curb the menace of Ponzi schemes and make such unregulated deposit scheme punishable.

What the ordinances is all about?

The legislation contains a substantive banning clause which bans deposit takers from promoting, operating, issuing advertisements or accepting deposits in any Unregulated Deposit Scheme.

Questions pinching the Industry as a whole

Q1. Whether the ordinance intends to ban all deposits as defined therein?

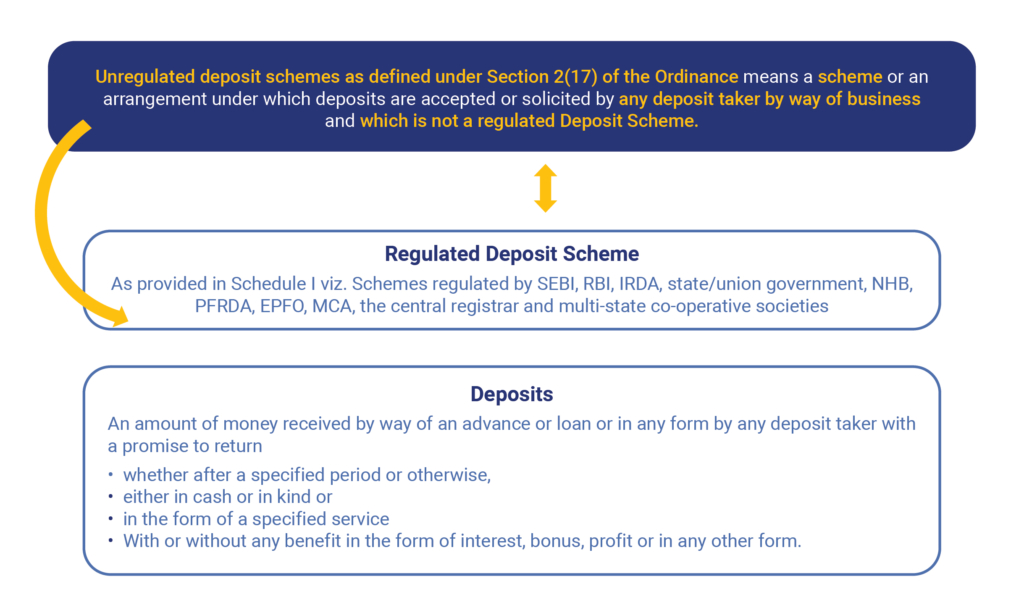

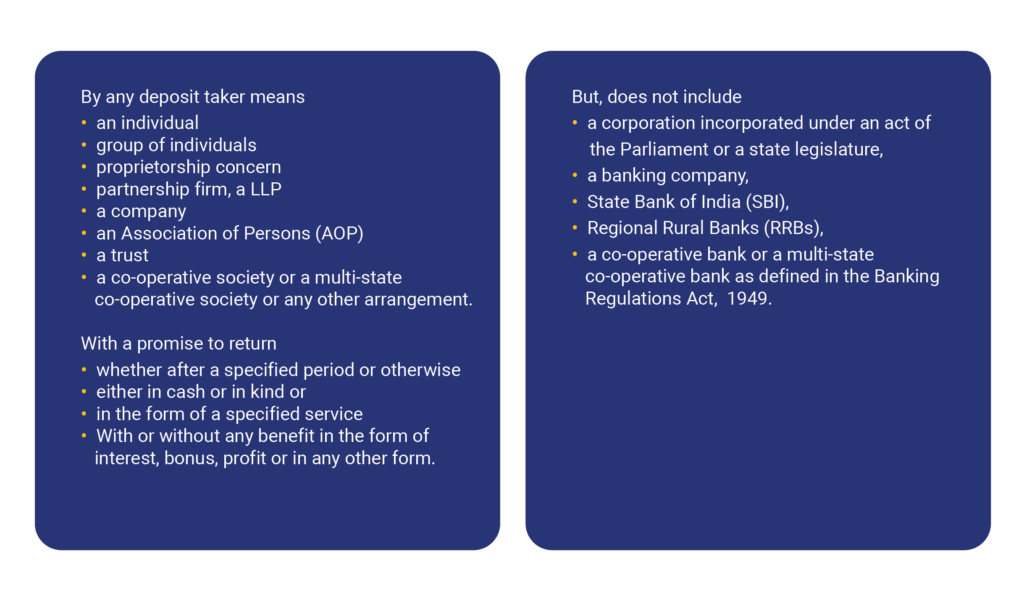

The term Deposits has been defined under Section 2(14) of the Ordinance as:An amount of money received by way of an advance or loan or in any other form, by any deposit taker:

List of activities excluded from the definition of deposits, i.e. kept out of the ambit of Deposits per se:

| S. No. | Activities |

| 1. | Loans received from banks; |

| 2. | Loans/ financial assistance from private finance institutions (PFIs) or any registered non-banking financial companies (NBFCs), regional financial institutions and insurance companies; |

| 3. | Amount received from or guaranteed by appropriate government; |

| 4. | Amount received from a statutory authority; |

| 5. | Amounts received from foreign government, foreign banks, and foreign authorities or person resident outside India as per the provisions of the Foreign Exchange Management Act (FEMA) 1999; |

| 6. | Capital contributions by partners of a partnership firm or LLP; |

| 7. | Loans received by an individual from his relatives; |

| 8. | Loans received by a firm from relatives of partners; |

| 9. | Any credit given by a seller to a buyer on the sale of any property (whether movable or immovable); |

| 10. | Amounts received by a registered Asset Reconstruction Company (ARC); |

| 11. | Amounts received under Section 34 or Section 29B of the Representation of the People Act, 1951; |

| 12. | Any periodic payment made by the members of self-help groups as per the ceiling prescribed by state/ Union territory government; |

| 13. | Amount received in the course of, or for the purpose of, business and bearing a genuine connection to such business for following and which has not become refundable (including for reasons where deposit taker did not obtain the necessary permission or approval under the law for the time being in force, wherever required, to deal in the goods or properties or services for which money is taken):a) Payment, advance or part payment for supply/ hire of goods / services;b) Advance received in connection with and adjusted towards consideration of an immoveable property under an agreement or arrangement;c) Security deposit;d) Advance under long-term projects for supply of capital goods; |

The definition of Deposits has been kept wide under the Ordinance, creating a lot of interest and confusion in the business circles about this law.

However, it should be noted that as per relevant Section 3 read with Section 2(17) of the Ordinance, the government has promulgated to ban any unregulated deposit scheme thereby restricting any deposit taker to promote, operate or do any such related activity including accepting of deposits in pursuance of any Unregulated Deposit Schemes. Nonetheless, it is nowhere intended to ban the “deposit” per se.

Q2. What shall be the impact of this ordinance on deposits from a third persons for genuine business for instance personal/business loans undertaken by any trading/manufacturing/service concern organised as proprietorship/partnership/individuals/Co. etc.?

The ordinance under Chapter II mandates banning of unregulated deposit schemes and deposit schemes here refers to acceptance/ solicitation of deposits by deposit takers by way of any business.

It is mentionable here that What should be understood “by way of any business” is of utmost importance. The term has nowhere been defined in the Ordinance itself or otherwise. However, based upon logical reasoning the author is of the view it refers to such businesses which are primarily involved in taking deposits i.e., where collecting deposit is the prime / substantial activity of the business. In case of normal business-liketrading, manufacturing or service providers etc., whether constituted as proprietorship/partnership or otherwise acceptance of deposits is not the primary activity hence they could not be termed as deposit takers by way of business.

Here, the intention of the lawmakers is to protect the depositors from being defrauded by illicit deposit / ponzi schemes like chit fund schemes, private committees etc. The normal business deposits/loansare not intended to be banned by such ordinance.

The above fact gets strengthened from the relevant Press Release Dated 20th February, 2018 By Finance Ministry appositely stating that “Deposit” is defined in such a manner that deposit takers are restricted from camouflaging public deposits as receipts, and at the same time not to curb or hinder acceptance of money by an establishment in the ordinary course of its business.

The suprafact further get reinforced via The Statement of Objects and Reasons to the Banning of Unregulated Deposits Schemes Bill 2018, the relevant extract is produced below

“Despite such diverse regulatory framework, schemes and arrangements leading to unauthorised collection of money and deposits fraudulently, by inducing public to invest in uncertain schemes promising high returns or other benefits, are still operating in the society.”

“The said Committee in its Report has recommended the requirement of “appropriate legislative provisions, coupled with effective administrative and enforcement measures in order to protect the hard-earned savings and investments made by millions of people”. Presently, there are considerable differences among State laws in protecting the interests of depositors, and many unregulated deposit taking schemes operate across State boundaries.”

Furthermore, the intention of banning only the unregulated deposit scheme could be understood from the Press Release Dated 03 August, 2018 By Finance Ministry (Status Report in Chit Fund Scam), relevant extract of such press release is briefed below as

“As of February, 2018, the Enforcement Directorate (ED) has taken up investigations in 52 cases against Ponzi schemes floated by firms/ companies under the provisions of the PML Act, 2002, where small investors have been cheated.”

“As of February, 2018, the Central Bureau of Investigation (CBI) has registered and investigated 133 cases in the last 3 years (11 in 2015, 12 in 2016 and 110 in 2017) against various Ponzi companies for fraud and scams on the basis of complaints and also on the basis of directions of the Courts.”

“The Banning of Unregulated Deposit Schemes Bill, 2018 has been introduced in the Lok Sabha on 18.07.2018. The proposed Bill will ban all such deposit schemes which are unregulated.”

Hence, the deposits/ loan from a third person for genuine business running shall not be regarded as aunregulated scheme for raising deposits and shall have no impact on account of such ordinance.

Q3. What shall be the ultimate Impact of the Ordinance?

Every Ponzi scheme results in creation of new laws and such reactive law-making adds to the business hardships of genuine entrepreneurs. Moreover, the penal provisions under such specially crafted laws are also equally scary.The intention of this ordinance is to prohibit unregulated depositschemes from defrauding investors considering the recent chit fund scams and ponzi schemes and not to pose any hardship to any genuine business preposition.